So, like the global cooling thread... why the heck did you need to start a new thread? You create new one with some random, poorly composed rambling instead of continuing a prior discussion.

I don't think you need to say that... pretty much every comment you make lacks any critical thinking.

That's interesting that you revel in bad forecasts of growth, but does your outlook change now that the 2nd look by the BEA ended up at 2.5% (the level that joshh thinks is "growing enough to be growing")?

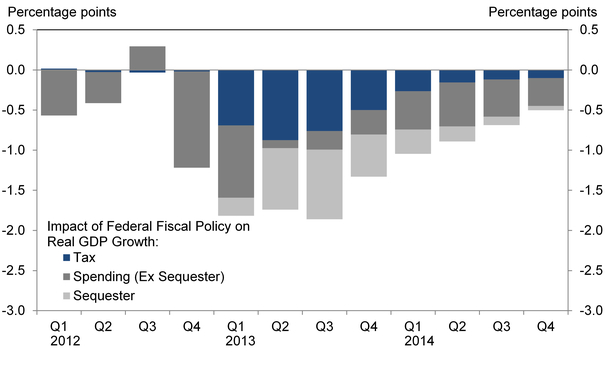

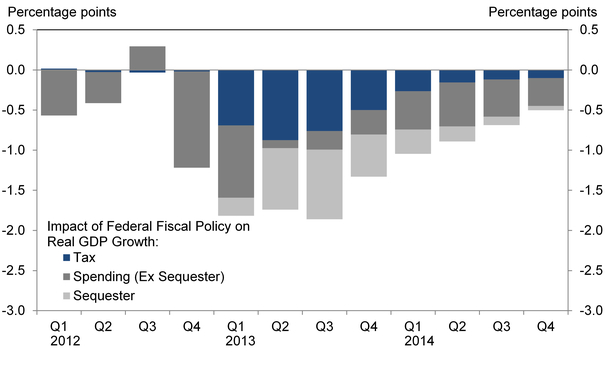

So whatever term you'd want to refer to it... (even though government spending was cut not just slowed in growth) check out its impact on GDP. Your words are worthless, try backing them up with data, facts, etc.

Eurozone Recovery Gathers Pace as Recession Exit Confirmed

What about some other data points?

ISM August Non-Manufacturing Index Rose to 58.6 From 56

U.S. August ISM Index: Manufacturing Expands at Fastest Pace in 2 Years

China output data reinforces view economy has steadied

Factory output growth hit a 17-month high and retail sales grew at their fastest pace this year in August

In U.S., China, Europe, data points to global rebound

Instead of gwb's idea that the EU and China would drag the US down, it seems that nando had a better vision:

And we've made strives to recover our competitiveness globally:

Switzerland Still Most Competitive Economy as U.S., Germany Gain

Originally posted by gwb72tii

View Post

Originally posted by gwb72tii

View Post

Originally posted by gwb72tii

View Post

So whatever term you'd want to refer to it... (even though government spending was cut not just slowed in growth) check out its impact on GDP. Your words are worthless, try backing them up with data, facts, etc.

Originally posted by gwb72tii

View Post

Eurozone Recovery Gathers Pace as Recession Exit Confirmed

What about some other data points?

ISM August Non-Manufacturing Index Rose to 58.6 From 56

Service industries in the U.S. expanded in August at the fastest pace in almost eight years as a pickup in demand encouraged companies to step up hiring, showing the world’s biggest economy is gaining momentum.

The Institute for Supply Management’s non-manufacturing index increased to 58.6 from 56 the prior month, the Tempe, Arizona-based group said today. The August figure, which exceeded the median forecast of 55, was the strongest since December 2005

The Institute for Supply Management’s non-manufacturing index increased to 58.6 from 56 the prior month, the Tempe, Arizona-based group said today. The August figure, which exceeded the median forecast of 55, was the strongest since December 2005

U.S. August ISM Index: Manufacturing Expands at Fastest Pace in 2 Years

China output data reinforces view economy has steadied

Factory output growth hit a 17-month high and retail sales grew at their fastest pace this year in August

In U.S., China, Europe, data points to global rebound

Instead of gwb's idea that the EU and China would drag the US down, it seems that nando had a better vision:

Originally posted by nando

View Post

Originally posted by nando

View Post

Switzerland Still Most Competitive Economy as U.S., Germany Gain

Switzerland held the top spot for a fifth year, while Germany and the U.S. rose two slots to fourth and fifth respectively in the Geneva-based organization’s 148-nation league. Singapore and Finland retained their second and third positions.

As emerging-market economies weaken, only Russia of the so-called BRIC nations improved its standing by climbing three places to 64th. China held on to the 29th rank, Brazil fell eight slots to 56th and India slipped one place to 60th.

Comment