Announcement

Collapse

No announcement yet.

"Pass this jobs bill!"

Collapse

X

-

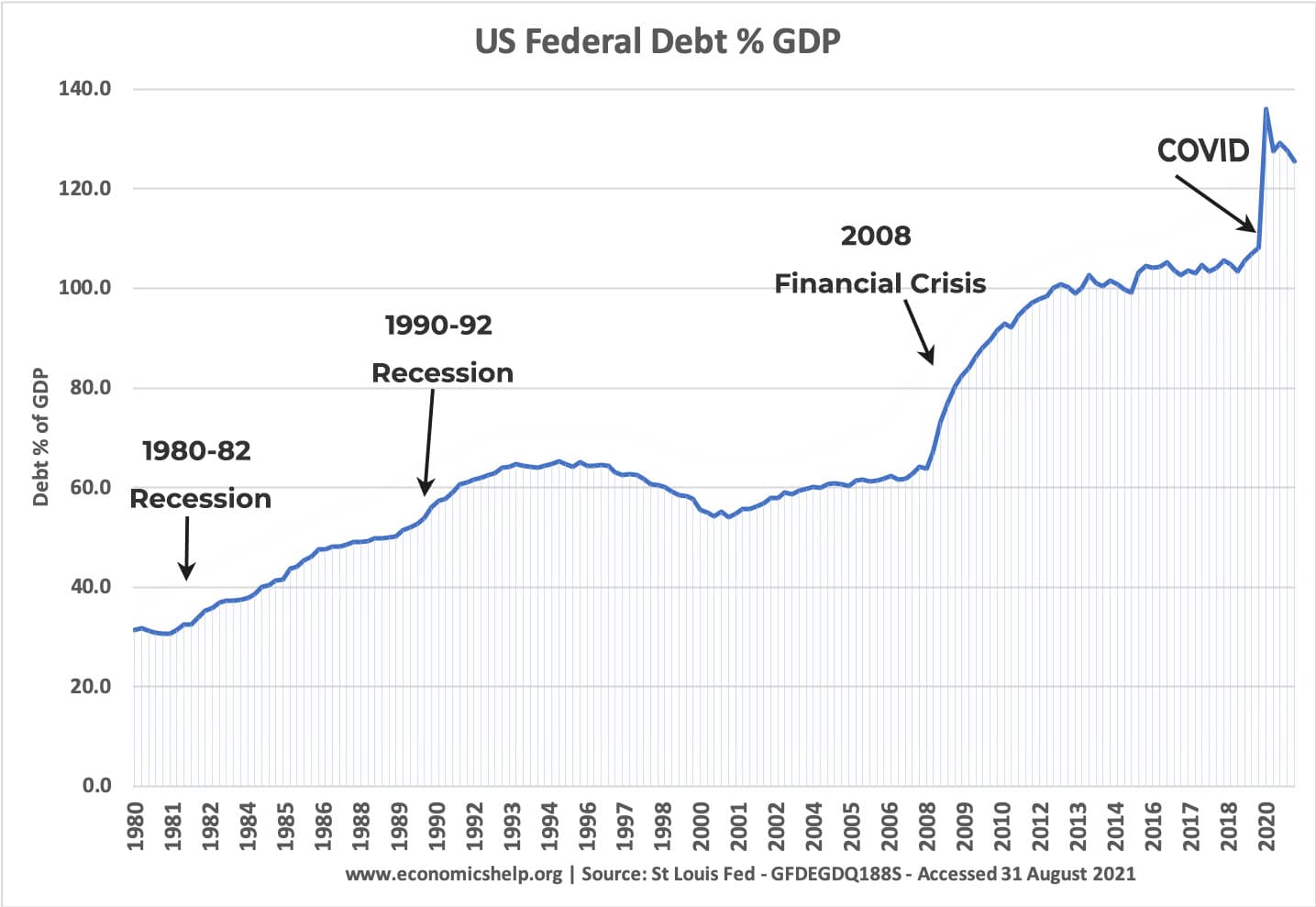

My chart looks correct. "Spending" and "Debt" are two different figures. The latter is affected not only by spending but also revenue and is not an annual figure but rather an accumulation of annual deficits from all previous years.

What would be more meaningful would be to look at annual revenue and deficit figures since 1900. I'll see if I can find some."I think we consider too much the good luck of the early bird and not enough the bad luck of the early worm."

-Franklin D. Roosevelt

Comment

-

the problem with keynesian economics is that when it doesn't work, and there are no examples i am aware of where it has, the proponents always argue it should have been more.

its a straw man argument, like the pres arguing without the spending things would have been worse.

its odd that keynesian proponents have no evidence to show that it works, but there are all kinds of examples that an economy grows when the government gets out of the way.

so now, after 1 trillion plus in gov't keynesian stimulus that has resulted in a slowing world economy and higher unemployment, we are supposed to believe another $500 billion of the same is the solution?

really??

you cannot push on a rope. the fed can create all kinds of excess capital at the banks thru QE2, lower rates to zero, flood the economy with cash, but the fed is powerless to compel anyone or any business to use the cash.

the admin made a big mistake early on, even if herbie wants to blame this on bush. the pres assumed all this keynesian would work, when anyone could have looked to japan, or FDR, and question at least whether it would work. obamacare got center stage while the economy continued to hemorage jobs. and now obama doesn't know what to do, its an election year, and even if he wanted he can't change without losing the last of his base before next november.

we're all inbetween a rock and a hard spot.

^^nice chart btw

anyone want to see year to year what excess spending looks like, there it is.Last edited by gwb72tii; 09-13-2011, 12:49 PM.“There is nothing government can give you that it hasn’t taken from you in the first place”

Sir Winston Churchill

Comment

-

^This guy (morrison)... uses facts. I approve.

All of these threads can (and should, but don't always) reach the same end conclusion. We need to cut spending AND increase taxes.

Sorry guys (I know alot of the fiscal conservatives here are reps/partiers) but we need to start taxing the wealthy of America again. Our distribution of wealth/income equality puts us something like 40 WORST by nation. Pretty sad. Am I saying everyone should make the same amount of money... obviously not. Just that those taking the lions share of the pie, should pay for most of the pie.

http://www.mongabay.com/reference/st...ings/2172.html"A good memory for quotes combined with a poor memory for attribution can lead to a false sense of originality."

-----------------------------------------

91 318is Turbo Sold

87 325 Daily driver Sold

06 4.8is X5

06 Mtec X3

05 4.4i X5 Sold

92 325ic Sold & Re-purchased

90 325i Sold

97 328is Sold

01 323ci Sold

92 325i Sold

83 528e Totaled

98 328i Sold

93 325i Sold

Comment

-

I agree that we can learn a few things from Japan's lost decade. They had a housing bubble just like ours, only they had theirs in 1989. Then they experienced deflation and a resulting liquidity trap. They tried to use fiscal policy along with increases in the money supply to their banking institutions. From what I understand of their fiscal policies is that they had good impact in terms of getting corporations to invest money in themselves, but didn't do a good job of putting money into consumers' hands. The modest increase in their money supply wasn't enough to curb deflation and even resulted in a credit crunch because banks weren't confident enough in borrowers to invest in them.

In a nutshell, their government botched how they spent their money. I believe they should have reduced the tax burden on consumers, thereby letting the free market decide where that money should be invested in the economy. And they also should have been a bit more aggressive in increasing their money supply. The theory isn't to blame; it's the execution."I think we consider too much the good luck of the early bird and not enough the bad luck of the early worm."

-Franklin D. Roosevelt

Comment

-

The article herbivor posted a few months ago showed great correlation between "supply-side" economics and stagnating middle class wages.Originally posted by Schnitzer318is View Post^This guy (morrison)... uses facts. I approve.

All of these threads can (and should, but don't always) reach the same end conclusion. We need to cut spending AND increase taxes.

Sorry guys (I know alot of the fiscal conservatives here are reps/partiers) but we need to start taxing the wealthy of America again. Our distribution of wealth/income equality puts us something like 40 WORST by nation. Pretty sad. Am I saying everyone should make the same amount of money... obviously not. Just that those taking the lions share of the pie, should pay for most of the pie.

http://www.mongabay.com/reference/st...ings/2172.html

To me it shows without a doubt that supply side economics created great wealth, however, it concentrated it all that top.

I say leave personal taxes where they are, dramatically cut spending (the Stimulus is now included in the baseline budget) and cut our corporate tax rate to a level that will encourage business to repatriate much of the overseas earning.

But politicians are afraid to enact the very necessary reform on the Ponzi scheme that is SS or any other entitlements.Need parts now? Need them cheap? steve@blunttech.com

Chief Sales Officer, Midwest Division—Blunt Tech Industries

www.gutenparts.com

One stop shopping for NEW, USED and EURO PARTS!

Comment

-

SS didn't become a ponzi scheme until the money got spent on other things. It was never meant to be a sole income but a supplemental part of retirement.Originally posted by z31maniac View PostBut politicians are afraid to enact the very necessary reform on the Ponzi scheme that is SS or any other entitlements.

At this point though I think many would be happy to just see an end to SS taxes and end the service all together. I know it would be quite a bit of extra money for my wife and I every month.

As for taxes... we are just going to have to agree to disagree there. We need to increase revenue and decrease spending to pay off the deficit. While initially federal/bureaucratic jobs will be lost and the economy affected negatively we will at least be on the path to re-instilling confidence to our debtors and re-valuing the dollar which we need greatly."A good memory for quotes combined with a poor memory for attribution can lead to a false sense of originality."

-----------------------------------------

91 318is Turbo Sold

87 325 Daily driver Sold

06 4.8is X5

06 Mtec X3

05 4.4i X5 Sold

92 325ic Sold & Re-purchased

90 325i Sold

97 328is Sold

01 323ci Sold

92 325i Sold

83 528e Totaled

98 328i Sold

93 325i Sold

Comment

-

^

by decreasing spending and stop threatening and regulating industry/business to beat hell you will increase revenue without having to do shit to the to the tax code up or down.

All though I think it needs a huge reform to the point of eliminating the IRS and going to a Fair tax or Flat tax and getting rid off the income taxes in totalityThe American Republic will endure until the day Congress discovers that it can bribe the public with the public's money. -Alexis de TocquevilleOriginally posted by FusionIf a car is the epitome of freedom, than an electric car is house arrest with your wife titty fucking your next door neighbor.

The Desire to Save Humanity is Always a False Front for the Urge to Rule it- H. L. Mencken

Necessity is the plea for every infringement of human freedom. It is the argument of tyrants.

William Pitt-

Comment

-

Originally posted by mrsleeve View Post^

by decreasing spending and stop threatening and regulating industry/business to beat hell you will increase revenue without having to do shit to the to the tax code up or down.

All though I think it needs a huge reform to the point of eliminating the IRS and going to a Fair tax or Flat tax and getting rid off the income taxes in totality

I concur :)Build your own dreams, or someone else will hire you to build theirs!

Your signature picture has been removed since it contained the Photobucket "upgrade your account" image.

Comment

-

I know you do ;)The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money. -Alexis de TocquevilleOriginally posted by FusionIf a car is the epitome of freedom, than an electric car is house arrest with your wife titty fucking your next door neighbor.

The Desire to Save Humanity is Always a False Front for the Urge to Rule it- H. L. Mencken

Necessity is the plea for every infringement of human freedom. It is the argument of tyrants.

William Pitt-

Comment

-

agreed and correctOriginally posted by mrsleeve View Post^

by decreasing spending and stop threatening and regulating industry/business to beat hell you will increase revenue without having to do shit to the to the tax code up or down.

All though I think it needs a huge reform to the point of eliminating the IRS and going to a Fair tax or Flat tax and getting rid off the income taxes in totality

higher tax rates have never resulted in more revenue to the fed

lower rates have

and the good thing about a consumption tax is everyone will have skin in the game“There is nothing government can give you that it hasn’t taken from you in the first place”

Sir Winston Churchill

Comment

-

This is a good spot for this.

By 2003, Mr. Bush grasped this lesson. In that year, he cut the dividend and capital gains rates to 15 percent each, and the economy responded. In two years, stocks rose 20 percent. In three years, $15 trillion of new wealth was created. The U.S. economy added 8 million new jobs from mid-2003 to early 2007, and the median household increased its wealth by $20,000 in real terms.

But the real jolt for tax-cutting opponents was that the 03 Bush tax cuts also generated a massive increase in federal tax receipts. From 2004 to 2007, federal tax revenues increased by $785 billion, the largest four-year increase in American history. According to the Treasury Department, individual and corporate income tax receipts were up 40 percent in the three years following the Bush tax cuts. And (bonus) the rich paid an even higher percentage of the total tax burden than they had at any time in at least the previous 40 years. This was news to theNew York Times, whose astonished editorial board could only describe the gains as a “surprise windfall.”

Unfortunately, Mr. Bush allowed Congress to spend away those additional tax revenues. The fact is that the increase in tax revenues that flowed from the ‘03 tax cuts could have paid for the wars in Afghanistan and Iraq and then some but for rampant discretionary domestic spending.

Ironically, Mr. Obama is in danger of repeating Mr. Bush’s early economic missteps, albeit on a grander scale. Like Mr. Bush in 2001, Mr. Obama based much of his ill-fated stimulus package on tax rebates but compounded this error by sending checks to Americans with no tax liability and by adding in costly government make-work projects. He also increased discretionary spending in his first year in office faster than Mr. Bush, all the while proposing a trillion-dollar health care plan and a financially ruinous cap-and-trade bill. He is now calling for a “jobs bill,” which is the White House’s new lingo for a second Keynesian-style stimulus (or third, counting Mr. Bush’s 2008 stimulus), pushing the 2010 deficit to an all-time record level.

Worse still, Mr. Obama’s $3.8 trillion budget for 2011 would allow the Bush tax cuts to expire, imposing new prosperity-killing taxes on businesses, investors and individuals. The president would do better to follow his predecessor and embrace the winning strategy of supply-side tax cuts. He even might find that Americans would welcome this new story line. After all, liberal economic fairy tales are growing tiresome, even for Massachusians.

Taxation is not the answer for this economic situation. Stop the ridiculous spending is. That includes the wars of course.Your signature picture has been removed since it contained the Photobucket "upgrade your account" image.

"I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending, on objects of benevolence, the money of their constituents. Charity is no part of the legislative duty of the [federal] government." ~ James Madison

"If you've got a business, you didn't build that. Somebody else made that happen" Barack Obama

Comment

-

Doug Elmendorf, head of the CBO, gave some advice to the super committe today. The full article is below with highlights of his recommendations in quotes.

The Congressional Budget Office is projecting that the nation’s unemployment rate will remain near 9 percent through 2012.The Congressional Budget Office is projecting that the nation’s unemployment rate will remain near 9 percent through 2012, its director said Tuesday in a debt “supercommittee” hearing.

The Congressional Budget Office is projecting that the nation’s unemployment rate will remain near 9 percent through 2012.The Congressional Budget Office is projecting that the nation’s unemployment rate will remain near 9 percent through 2012, its director said Tuesday in a debt “supercommittee” hearing.

“There is no commonly agreed upon level of federal debt that is sustainable or optimal,” Elmendorf said, according to prepared remarks. “At a minimum, federal debt cannot continually increase as a share of the economy because the interest payments on that debt would then continually grow relative to the size of the tax base that would be available for generating revenues to cover those payments and all of the other activities of the government.”

The “supercommittee” has been charged with cutting the deficit by $1.2 trillion to $1.5 trillion by Thanksgiving or risk automatic cuts to agencies and entitlement programs. But some lawmakers, business leaders and others have urged it to be more ambitious. Elmendorf said if the committee achieves its $1.2 trillion goal, public debt would drop from 67 to 61 percent of the gross domestic product by 2021.

To reduce the public debt to 50 percent of the nation’s total economic output, the same level recorded in the mid-1990s, the committee would have to find $3.8 trillion instead.

Elmendorf told the group that their choices for achieving deficit reduction, as has been widely agreed, include raising federal tax revenues significantly, making major changes to benefits to older Americans or substantially reducing the size of the government relative to the size of the economy.

“The nation cannot continue to sustain the spending programs and policies of the past with the tax revenues it has been accustomed to paying,” he said, according to prepared remarks. “Citizens will either have to pay more for their government, accept less in government services and benefits, or both.”sigpic

Comment

Comment